INDIVA REPORTS RECORD FISCAL YEAR 2022 RESULTS

Indiva Remains the National Market Share Leader in the Edibles Category

LONDON, Ontario – April 18, 2023: Indiva Limited (the “Company” or “Indiva”) (TSXV:NDVA), the leading Canadian producer of cannabis edibles and other cannabis products, is pleased to announce its financial and operating results for the fourth quarter and fiscal year ended December 31, 2022. All figures are reported in Canadian dollars ($), unless otherwise indicated. Indiva’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). For a more comprehensive overview of the corporate and financial highlights presented in this news release, please refer to Indiva’s Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Year Ended December 31, 2022, and the Company’s Consolidated Financial Statements for the Years Ended December 31, 2022 and 2021, which are filed on SEDAR and available on the Company’s website, www.indiva.com.

“We are pleased to report record revenue and record gross profit for the fiscal year 2022. Indiva continued to be the national market share leader in edibles throughout 2022. In the fourth quarter, as per Hifyre data, Indiva was ranked 13th out of 164 licensed producers by consolidated market share across all categories in the five major provinces where edibles sales are permitted. On a units shipped basis, Indiva ranked 3rd nationally in the fourth quarter, making Indiva one of the most important suppliers to provincial wholesalers and retailers. Our distribution reaches all 13 provinces and territories in Canada, as well as multiple medical partners, including Tilray, with whom Indiva recently signed an agreement to provide its industry leading edibles products to patients registered on their medical platform.” said Niel Marotta, President and Chief Executive Officer of Indiva. “While Indiva has, and will continue to benefit from several successful licensing deals, including Wana Sour Gummies, Bhang Chocolate, Pearls by Grön, and Dime Industries, our focus has now shifted primarily to innovation. In 2022, Indiva introduced several new products from in-house innovation under the Indiva Life brand including Lozenges, Chocolates, Capsules and Sandwich Cookies. Looking forward to 2023, Indiva will continue to innovate and introduce new products which leverage our national distribution platform, our position as a low-cost producer of edibles and our ranking as the national market share leader in the category. While we diligently advocate in favour of badly needed regulatory reform allowing for higher THC potency per package in edibles, Indiva remains committed to bringing best-in-class products that delight of-age Canadian cannabis enthusiasts and patients coast-to-coast.”

HIGHLIGHTS

Quarterly Performance

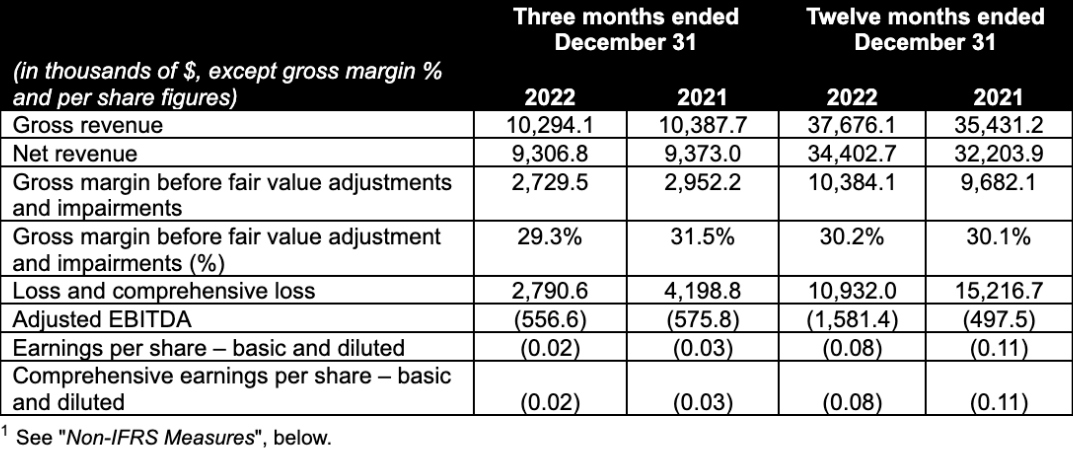

- Gross revenue in Q4 2022 at $10.3 million, representing a 17.1% sequential increase from Q3 2022, and a 0.9% decrease year-over-year from Q4 2021.

- Net revenue in Q4 2022 was $9.3 million, representing a 15.0% sequential increase from Q3 2022, and a 0.7% decrease year-over-year from Q4 2021, driven primarily by new product introduction offset by weaker sales of Wana Sour Gummies.

- Net revenue from edible products was $7.5 million in Q4 2022, up 3.0% from $7.3 million in Q3 2022 and down 10.9% from $8.4 million in the prior year period. Edible product sales declined year-over-year to 80.6% of net revenue in Q4 2022, due to higher sales of ingestible extracts.

- Gross profit before fair value adjustments, impairments and one-time items was $2.7 million, or 29.3% of net revenue, versus 28.9% in Q3 2022 and 31.5% in Q4 2021. The decline in gross margin percentage year over year was due to delays in deliveries of automated processing equipment related primarily to new products and a shift in product mix in the fourth quarter towards edible products with higher average cannabinoid content per unit and lower gross margin. The Company expects margins to improve in Q1 2023 due to the implementation of some of the new automation equipment for production and packaging of edible products.

- In Q4 2022, Indiva sold products containing a record 81.8 million milligrams of cannabinoids, the active ingredient in edible products, which represents a 44.8% increase when compared to the 56.5 million milligrams in product sold in Q3 2022, and a 35.5% increase compared to 60.4 million milligrams sold in Q4 2021.

- Impairment charges in the quarter totaled $0.5 million. This impairment includes a write off of aged finished goods and bulk cannabis products due to aging inventory and obsolete packaging, as well as a write down to net realizable value of high cost cannabis flower and slower moving oil-based products. The Company will continue to work to monetize any impaired inventory which remains saleable.

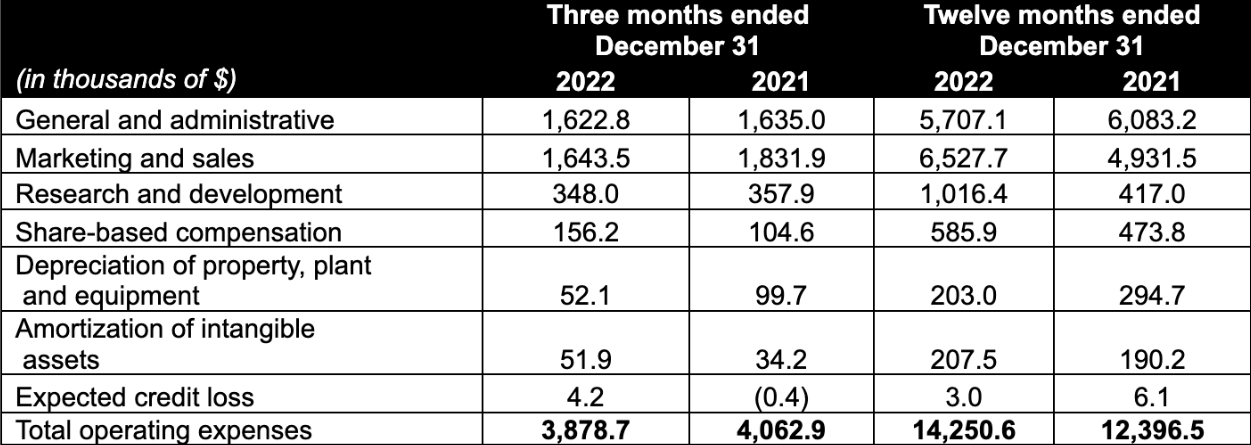

- Operating expenses in the quarter decreased 4.5% year over year to $3.9 million or 41.7% of net revenue versus 41.8% in Q3 2022 and 43.3% in Q4 2021, due to lower marketing costs, which were partially offset by increased sales expenditures, while general and administrative costs remained flat.

- Adjusted EBITDA declined sequentially in Q4 2022 to a loss of $0.6 million, versus a loss of $0.5 million in Q3 2022 while it remained flat versus a loss of $0.6 million in Q4 2021. See “Non-IFRS Measures“, below.

- Comprehensive net loss included one-time expenses and non-cash charges including inventory impairments and losses on modification of debt totaling $0.5 million in Q4 2022 and $1.5 million in Q4 2021. Excluding these charges, comprehensive loss declined to $2.4 million in Q4 2022 versus a loss of $2.7 million in Q4 2021.

Fiscal Year 2022 Performance

- Record gross revenue for the year ended December 31, 2022 was $37.7 million versus $35.4 million for the year ended December 31, 2021, representing a 6.3% year-over-year increase.

- Record net revenue for the year ended December 31, 2022 was $34.4 million versus $32.2 million for the year ended December 31, 2021, representing a 6.8% year-over-year increase. Net revenue growth was driven primarily by new product introductions offset by lower sales of Wana Sour Gummies.

- Net revenue from edible products grew to $30.5 million, representing 88.7% of net revenue for the year ended December 31, 2022, versus $29.8 million or 92.5% of net revenue in the prior year period.

- Gross margin before fair value adjustments and impairments improved slightly to a record $10.4 million or 30.2% of net revenue versus $9.7 million or 30.1% of net revenue for the year ended December 31, 2021, due to increased operating efficiency offset by a product mix shift. The Company experienced delays in receiving new automated equipment, which was only delivered and commissioned at the end of 2022, resulting in expected gross margin benefits to be delayed until 2023.

- In 2022, Indiva sold products containing 237.1 million milligrams of cannabinoids, the active ingredient in edible products, which represents a 28.5% increase when compared to the 184.5 million milligrams in product sold in 2021.

- Operating expenses increased by 15.0% versus the year ended 2021, primarily due to higher marketing and sales expenses as well as higher research and development expenses resulting from the Company increasing its focus on in-house innovation. General and administrative costs decreased 6.2% for the year versus 2021. As a percentage of net revenue, operating expenses increased to 41.4% for 2022 versus 38.5% in 2021.

- Adjusted EBITDA decreased to a loss of $1.6 million versus a loss of $0.5 million last year due to higher sales and marketing expenses and research and development expenses.

- Impairment and one-time charges for the year totaled $2.2 million. This write-off includes a provision for aged finished goods and bulk cannabis products due to aging inventory.

- Comprehensive net loss, excluding one-time expenses and non-cash charges, increased to $8.6 million in fiscal year 2022, versus a loss of $5.4 million in fiscal year 2021.

Operational Highlights for the Fiscal Year 2022

- Pearls by Grön LLC (“Grön“): Indiva began production of Pearls gummies in mid-2022, and completed initial deliveries to Ontario in August 2022, followed by deliveries to British Columbia, Manitoba and Saskatchewan. The first four flavours released were Blue Razzleberry 3:1 CBG:THC, Sour Apple THC, Blackberry Lemonade 1:1:1 CBN:CBD:THC and Pomegranate 4:1 CBD:THC. Subsequently, the Company introduced three additional flavours: Strawberry Melon 4:1 CBN:THC, Cherry Limeade THC, and Marionberry Lemonade CBG, which comes in a multipack of 25 gummies, bringing the total number of Pearls gummie SKUs in market to seven. Pearls by Grön have quickly become one of the top-selling edibles in the country. Subsequent to year-end, Pearls by Grön completed its registration in Alberta required to enter the market. Initial deliveries of Pearls into this important market are planned for May 2023 and are expected to contribute meaningful revenue and market share.

- Indiva introduced several new products under the Indiva Life brand including:

- Indiva Life Double-Stuffed Sandwich Cookies: Available in Vanilla and Fudge flavours, containing 10mg of THC per cookie, adding substantially to Indiva’s market share in the baked goods sub-category. Subsequent to year end, Indiva introduced Strawberry and Golden Vanilla flavours.

- Indiva Life Capsules: Three new 30-count capsule formats became available, including Zen CBD:CBN 1:1, Sunrise CBG:THC 1:1 and Sunset CBN:THC 1:1.

- Indiva Life Chocolates: Irish White Chocolate THC delivered in Ontario, with Evening Milk Chocolate CBN:CBD 1:1 and Afternoon Trail Mix Milk Chocolate CBG:THC 1:1 becoming available in Q4 2022 in both Ontario and British Columbia.

- Indiva Life Lozenges: This innovative extract product in Lemon and Wild Cherry flavours is available in 10-pack, 25-pack and 50-pack counts. Lemon Lozenges became available in Ontario in a 10-pack and 50-pack format and Wild Cherry in a 10-pack and 25-pack format, while in British Columbia and Alberta both flavours were launched in a 25-pack format.

- Dime Industries (“Dime”): Indiva signed an exclusive licensing and manufacturing agreement with Dime in the spring of 2022. The agreement has a five year term which automatically renews for three additional five year terms. Indiva launched Dime’s proprietary and innovative vape products, including 510-thread carts and custom batteries in Ontario in Q3 2022, marking Indiva’s first entrance into the vape category. Indiva also introduced a proprietary Dime battery and 510-thread Dime OG and Bubblegum Kush carts, both of which became available in October. Subsequent to year-end, Indiva introduced a 510-thread Blueberry Lemon Haze Sativa cart and Wedding Cake Hybrid Rechargeable All-in-One vape in Ontario.

- Wana Sour Gummies: New product introductions in 2022 include Wana Quick Midnight Berry and Classic Midnight Berry Indica CBN/CBD/THC 5:10:2, available in a 5-pack. Indiva also introduced two additional gummie SKUs nationally under the Wana Quick brand, namely Lemon Cream and Island Punch, as well as Wana Passion Fruit under Wana Classic.

- Bhang Corporation (“Bhang“) Chocolate: Indiva launched Bhang THC Toffee and Salt Milk Chocolate, bringing total SKUs in market to nine. Bhang continues to hold the #1 market share in the chocolate sub-category.

- Awards: Pearls by Grön won an award from Kind Magazine for Best Edible Innovation and Artisan Batch was awarded Best in Grow from Cannabis NB for best Indica flower.

- Distribution: Indiva expanded its distribution coast-to-coast-to-coast to all 10 provinces and three territories by adding a supply agreement with Nunavut in Q1 2022. Subsequent to year-end, Indiva added Tilray Brands, Inc (“Tilray“) to its list of medical distributors.

- Licensing: Indiva was granted aresearch licence from Health Canada, which will allow the Company to conduct sensory evaluation trials on site of medicated samples.

- Automation: Building on Indiva’s strength as a best-in-class manufacturer and the low-cost producer of edibles, the Company commissioned several new pieces of automated equipment during the fourth quarter at its facility in London, Ontario, for use in the processing and packaging of edible products. The margin benefit from implementing automation will begin to be realized in Q1 2023.

- Convertible debt extension: The Company announced that debenture holders representing $2,740,000 of the $2,990,000 principal outstanding agreed to amend their debentures to extend the maturity date to December 31, 2024 and lower the conversion price to $0.15 per common share in the capital of the Company.

Events Subsequent to Year End

- New medical customer: Indiva is delighted to begin supplying Tilray’s medical platform with Indiva products. Products are now available to Tilray medical patients including Pearls by Grön, Wana Sour Gummies, Bhang Chocolate as well as Indiva Life Double-Stuffed Sandwich Cookies.

- Pearls by Grön: Pearls gummies continue to gain market share in Ontario and British Columbia, quickly becoming one of the top edibles in the country. Late in Q1, Grön received cannabis representative registration acceptance from the Province of Alberta, which will allow Indiva to launch Pearls in this market in the coming weeks.

- Indiva signed a non-exclusive agreement with Valiant Distribution Cannabis, a subsidiary of Canna Cabana Inc, for the distribution of its products in the province of Saskatchewan. This agreement simplifies Indiva’s path to market in Saskatchewan and substantially reduces shipping costs.

- Per the news release dated March 14, 2023, the Company received notification from Health Canada of its determination that certain of its lozenges have been improperly classified as an “extract” rather than an “edible” under applicable cannabis regulations. Health Canada requested that Indiva cease production of the lozenges, and Indiva immediately complied with such order. The lozenges subject to this determination are the Indiva Life Wild Cherry THC Lozenges and Indiva Life Lemon THC Lozenges in their 100 mg, 250 mg and 500 mg THC per package formats (the “Products”). Prior to the launch of the Products, the Company closely considered the regulatory requirements of the legislation, including with respect to product classification, and conducted substantial research. Consistent with the legislative requirements and the Company’s research, the Company classified the Products as cannabis extracts. The Company may choose to continue manufacturing the Products in alternative packaging formats.

Market Share

- Data from Hifyre Inc. (“Hifyre“) for the fourth quarter of 2022 shows strong sell-through of Indiva’s edible products. With 28.8% share of sales, Indiva continues to lead in the #1 market share position in the edibles category on an aggregate basis:

-

- Ontario: #1 with 30.5% market share.

- Alberta: #1 with 23.9% market share.

- British Columbia: #1 with 35.0% market share.

- Saskatchewan: #2 with 17.1% market share.

- Manitoba: #2 with 24.3% market share.

- Wana™ Sour Gummies led the edibles category, with 19.0% category share and 25.1% sub-category share, and Bhang® continued to lead the chocolate category with 38.0% sub-category share.

- Pearls by Grön gummies recently launched during Q4 with 4.8% sub-category share.

- Indiva also led the baked goods category with 49.6% sub-category share which includes recently launched Indiva Life Double-Stuffed Cookies.

- Product ranking in Q4 2022 showed four of the Top 10 edible SKUs are from Indiva.

- Based on data from British Columbia, Alberta, Ontario, Manitoba and Saskatchewan, the edibles category increased by 7% in Q4 2022 to $61.8 million in retail sales from $57.5 million in Q3 2022, and increased by 24% versus $50.7 million in Q4 2021.

Outlook

- The Company expects that Q1 2023 net revenue will be down slightly on a sequential basis, but higher year-over-year, due to the benefit of broader distribution of new products, offset by lower sales of ingestible extracts. Margins are also expected to improve sequentially in Q1 2023 due to the benefit of the implementation of automation in the production and packaging of edible products. Indiva also expects to continue to drive growth through innovation and introduction of new products across our national distribution platform in 2023.

OPERATING AND FINANCIAL RESULTS FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2022

Operating Expenses

CONFERENCE CALL – Tuesday, April 18, 2023 at 8:30 a.m. (EST):

The Company will host a conference call to discuss its results on Tuesday, April 18, 2023 at 8:30 a.m. (EST). Interested participants can join by dialing 416-764-8658 or 1-888-886-7786. The conference ID is 00296074.

A recording of the conference call will be available for replay following the call. To access the recording please dial 416-764-8691 or 1-877-674-6060. The replay ID is 296074#. The recording will remain available until Thursday, May 18, 2023.

About Indiva

Indiva sets the standard for quality and innovation in cannabis. As a Canadian licensed producer, Indiva produces and distributes award-winning cannabis products nationally, including Bhang® Chocolate, Wana™ Sour Gummies, Jewels Chewable Tablets, Grön edibles, Dime Industries™ vape products, as well as capsules, edibles, extracts, pre-rolls and premium flower under the INDIVA, Indiva Life and Artisan Batch brands. Click here to connect with Indiva on LinkedIn, Instagram, Twitter and Facebook, and here to find more information on the Company and its products.

Contacts

Investor Contact

Anthony Simone

Phone: 416-881-5154

Email: [email protected]

DISCLAIMER AND READER ADVISORY

General

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has in any way passed upon the merits of the contents of this news release and neither of the foregoing entities accepts responsibility for the adequacy or accuracy of this news release or has in any way approved or disapproved of the contents of this news release.

Certain statements contained in this news release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the parties’ current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this news release contains forward-looking information relating to, among other things, (i) the Company’s outlook for and expected operating margins and future financial results, (ii) the projected growth of its business and operations (including existing and new segments thereof), and the future business activities of, and developments related to, the Company within such segments after the date of this news release, (iii) additional jurisdictions within which the Company may establish its operations or business footprint, (iv) the Company’s ability to capture and/or maintain its market share in any jurisdiction, (v) the Company’s ability to deliver on its commitments for existing or new listings of products, (vi) the Company’s ability to benefit from its licensing deals, (vii) the Company’s ability to continue to innovate and introduce new products, (viii) the Company’s ability to monetize any impaired inventory which remains saleable, (ix) the Company’s ability to conduct sensory evaluation trials of medicated samples on site, and (x) the Company realizing the benefits of automation. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to the Company, and include, without limitation, assumptions about the Company’s future business objectives, goals, and capabilities, the cannabis market, the regulatory framework applicable to the Company and its operations, and the Company’s financial resources. Although the Company believes that the assumptions underlying, and the expectations reflected in, forward-looking statements in this news release are reasonable, it can give no assurance that such expectations will prove to have been correct. A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements. Specifically, readers are cautioned that forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, but not limited to, risks and uncertainties related to: (i) the available funds of the Company and the anticipated use of such funds, (ii) the availability of financing opportunities, (iii) legal and regulatory risks inherent in the cannabis industry, (iv) risks associated with economic conditions, (v) dependence on management, (vi) public opinion and perception of the cannabis industry, (vii) risks related to contracts with third-party service providers, (vii) risks related to the enforceability of contracts, (viii) reliance on the expertise and judgment of senior management of the Company, and ability to retain such senior management, (ix) risks related to proprietary intellectual property and potential infringement by third-parties, (x) risks relating to the management of growth and/or increasing competition in the industry, (xi) risks associated to cannabis products manufactured for human consumption, including potential product recalls, (xii) risks related to the economy generally, and (xiii) risk of litigation.

The forward-looking information contained in this news release is made as of the date hereof and the Company is not obligated to, and does not undertake to, update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions inherent in forward-looking information, investors should not place undue reliance on forward looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

This news release contains future-oriented financial information and financial outlook information (collectively, “FOFI“) about the Company’s prospective results of operations, which are subject to the same assumptions, risk factors, limitations, and qualifications as set out in the above paragraph. FOFI contained in this news release was approved by management as of the date of this news release and was provided for the purpose of providing further information about the Company’s future business operations. The Company disclaims any intention or obligation to update or revise any FOFI contained in this news release, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that the FOFI contained in this document should not be used for purposes other than for which it is disclosed herein.

Non-IFRS Measures

This news release makes reference to certain non-IFRS measures. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.

The non-IFRS measure used in this news release includes “Adjusted EBITDA”. The Company calculates Adjusted EBITDA as a sum of net revenue, other income, cost of inventory sold, production salaries and wages, production supplies and expense, general and administrative expense, and sales and marketing expense, as determined by management. Adjusted license fee eliminates 50% of the fee which is equivalent to the Company’s share of the joint venture company to which the license fee is paid. Adjusted EBITDA is provided to assist readers in determining the ability of the Company to generate cash from operations and to cover financial charges. Management believes that Adjusted EBITDA provides useful information to investors as it is an important indicator of an issuer’s ability to generate liquidity through cash flow from operating activities and equity accounted investees. Adjusted EBITDA is also used by investors and analysts for assessing financial performance and for the purpose of valuing an issuer, including calculating financial and leverage ratios. The most directly comparable financial measure that is disclosed in the financial statements of the Company to which the non-IFRS measure relates is income (loss) from operations.