Not for distribution to U.S. Newswire Services or for dissemination in the United States.

Indiva Reports Second Quarter Fiscal 2019 Results

LONDON, Ontario – August 29, 2019: Indiva Limited (the “Company” or “Indiva”) (TSXV:NDVA) (OTCQX:NDVAF) today announced its financial and operating results for the second quarter ending June 30, 2019. All figures are reported in Canadian dollars ($), unless otherwise indicated. Indiva’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). For a more comprehensive overview of the corporate and financial highlights presented in this press release, please refer to Indiva’s Management’s Discussion and Analysis of Financial Condition and Results of Operations for the three and six month periods ended June 30, 2019, and the Company’s Condensed Consolidated Interim Financial Statements for the three and six month periods ended June 30, 2019, which are filed on SEDAR and available on the Company’s website www.indiva.com.

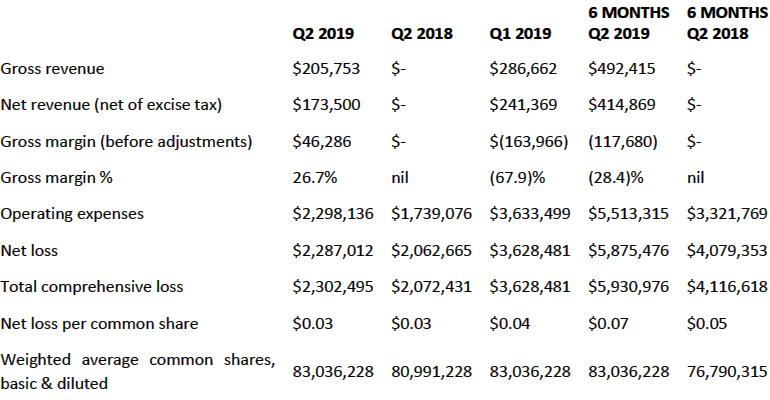

KEY OPERATING RESULTS AND HIGHLIGHTS FROM Q2 2019

- Net revenues totaled $173,500 versus nil in Q2 2018, and $241,369 in Q1 2019. This was due to lower deliveries to the Ontario Cannabis Store (OCS) as a result of regulatory delays.

- Gross margin, excluding fair-value adjustments, greatly improved to $46,286 or 27% of net sales versus a loss in Q1 2019 of $163,966. This was mostly due to lower input costs and improved processing efficiencies.

- Net loss increased to $2.3 million from $2.1 million in Q2 2018, but declined sequentially from a loss of $3.6 million in Q1 2019. This was as a result of improved cost control and lower one-time expenses.

- Total assets decreased to $30.2 million from $35.8 million at the end of fiscal year 2018 due to losses from operations as Indiva continued to scale up its production.

- Cash and cash equivalents available totaled $3.9 million compared to $19.6 million at the end of fiscal year This was due primarily to the acquisition of the production facility and the capital expenditures associated with its retrofit and expansion.

- INDIVATM pre-rolls continued to perform well with strains consistently placing in the top 10 in Ontario, both through online sales and on a wholesale basis.

PRODUCTION AND DISTRIBUTION EXPANSION

- In January 2019, Indiva engaged Lucid Lab Group to design, construct and commission an ethanol- based extraction operation at its facility in London, Ontario. Indiva expects to complete construction of its manufacturing, processing and refinement space in Q4 2019. Indiva expects that the extractor will process 70 tonnes of biomass resulting in more than 4 million grams of distillate. Indiva expects that the anticipated output from its future extraction operations will meet the Company’s needs and the Company intends to continue to partner with Canadian licensed producers to provide extraction, refinement and manufacturing services. The commencement of extraction operations at Indiva’s facility is subject to Health Canada approval.

- On May 31, 2019, three additional grow rooms and three additional processing rooms received the necessary licences from Health Canada. This capacity expansion is expected to increase dry flower output to more than 1,000 kg. Two of the newly-licensed rooms were populated by quarter end and the third was populated in early July 2019. The Company anticipates that these rooms will be harvested during Q3 2019. Pending Health Canada approval, new fully-built rooms, including three additional grow rooms and two additional processing rooms, are expected to be brought online in Q3 2019.

- On July 24, 2019, Indiva announced that it was approved to distribute dry flower, pre-rolls and capsules to Quebec enabling access to more than 17 million potential of-age consumers. Indiva anticipates that it will deliver its first shipment to the Société québécoise du cannabis (SQDC) in Q4 2019.

- On August 7, 2019, Indiva announced that it entered into a definitive agreement to provide extraction services to TerrAscend. Under the terms of the agreement, TerrAscend commits to providing a minimum of 800 kg per year of dry flower to Indiva for extraction.

- Upon receipt of an amendment to the Company’s licence to permit the sale of cannabis oils, Indiva will deliver tinctures and capsules to the adult-use recreational market through the OCS and SQDC, and direct-to-patient in the medical market.

“I am pleased with the solid foundation that we have built as we look ahead towards the legalization of edibles and derivative products in Canada,” Niel Marotta, Indiva’s President and Chief Executive Officer said. “Our strategic focus has always been on delivering exceptional cannabis and cannabis-infused products, as laws permit. Since our inception, we have secured partnerships and established joint ventures to gain exclusive access in Canada to formulations from award-winning U.S. brands like BhangTM and RubyTM. Our results from the second quarter show improved and positive gross margins, and incremental licensed capacity, which came online in late Q2 2019. Going forward, we believe that this additional capacity will drive significant sequential and year-over-year revenue growth. Indiva remains 100% committed to operating within the rules of the Cannabis Act as we patiently await our licence amendments. Our recent announcement to provide extraction services to TerrAscend is an example of our focus on being a provider of premium cannabis products and a partner to our fellow licensed producers. Finally, as we look ahead to Cannabis 2.0, Indiva is perfectly positioned to lead. As we receive the necessary licences, we expect to deliver safe, high-quality edibles and derivatives that make a mark on Canada’s cannabis industry.”

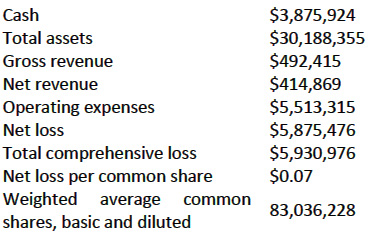

SELECT FINANCIAL INFORMATION SIX MONTHS ENDED JUNE 30, 2019

OPERATING AND FINANCIAL METRICS FOR Q2 FISCAL 2019

- Q2 2019 net revenue of $173,500 primarily represented sales from approximately 25 kg of pre- rolls compared to net revenue of $241,369 on sales of 36 kg of pre-rolls in Q1 2019. Net revenue was nil in Q2 For the first six months of 2019, net revenue totaled $492,415 versus nil in the first six months of 2018. In Q2 2019, INDIVA™ pre-rolls consistently placed in the top ten for sales in Ontario, both on a wholesale basis and online. Regulatory delays constraining additional capacity, as well as timing issues related to shipment of product, negatively influenced the Company’s ability to deliver more product to market slowing net revenue growth in this quarter. The Company expects to bring tinctures, capsules and new premium strains to established and new markets in Q3 and Q4 2019. The Company anticipates that this, combined with additional licensed capacity, which came online in late Q2 2019, will positively influence net revenue growth on a sequential and year-over-year basis for the remainder of the fiscal year.

- Q2 2019 gross margin, before fair value adjustments, was $46,286 or 27% of net revenue in the quarter, which was a marked improvement from the loss experienced in the previous quarter. Additionally, the Company has added more employees in anticipation of receiving Health Canada approval for its additional grow and processing rooms.

- Current inventory sits at $1.7 million with $1.49 million being attributed directly to cannabis and derivatives. Indiva currently has four grow rooms in operation and three additional fully-built grow rooms awaiting Health Canada approval. In Q3 2019, Indiva intends to deliver new strains such as Super Silver Haze to available markets. Once Indiva receives Health Canada approval to sell cannabis oils, it will also deliver INDIVA™ tinctures and capsules to the adult-use recreational market and medical market.

- Q2 2019 operating expenses were $2.3 million, which declined from Q1 2019 due to a reduction in professional fees and one-time expenses related to severance and rent deposit write-offs. These were offset by higher salaries and general and administrative costs attributable to Indiva’s growing employee count. Indiva continues to maintain a tight cost structure and spending controls, especially as it relates to overhead. The Company expects to continue to be strategic with its marketing and sales with a view towards supporting growth while strictly adhering to Health Canada’s cannabis promotion prohibition.

- Q2 2019 net loss from operations narrowed to $2.3 million from $3.6 million in Q1 2019 and rose slightly from $2.1 million in Q2 This was largely due to lower one-time costs related to lease buyouts and terminations. Net loss and comprehensive loss per share, basic and diluted, in Q2 2019 was $0.03, which was flat with Q2 2018, and down from a loss of $0.04 in Q1 2019.

POSITIONED TO LEAD IN CANNABIS 2.0

Cannabis 2.0 presents a significant opportunity in Canada and the Company is well positioned to capitalize on the availability of new products in the marketplace. Indiva is positioned to deliver premium products, backed by U.S.-based national leaders in edible formulations, to new and experienced cannabis consumers. As the exclusive producer and distributor of BhangTM chocolate in Canada, through a joint venture, Indiva anticipates having the necessary capacity to meet consumer demand and some of the best-tasting products on the market.

As recently reported by Lift & Co. and Ernst and Young, the legalization of edibles and derivative products may introduce 3 million new consumers to the cannabis market, with 1.5 million directly attributed to edibles consumption. Statistics Canada data also suggests that women, who make up a disproportionately small amount of current consumers, are three times more likely than their male counterparts to consume cannabis through oils, edibles and derivative products. Indiva remains committed to providing new and established consumers with the very best cannabis in a variety of formats at a reasonable price.

With more retail locations opening in Ontario and nationwide, Indiva plans to explore new provincial partnerships to distribute INDIVA™, Bhang™, and Ruby™ products to Canadians coast-to-coast. As the Company transitions from infrastructure and capacity building to leveraging the economies of scale, Indiva is prepared to evolve from a craft provider to a national partner and distributor of products that stand out for their quality and creativity.

About Indiva

Indiva’s global family of cannabis brands set the standard for quality and innovation. Indiva aims to bring its exceptional portfolio of products to Canadians and cannabis enthusiasts around the world as laws permit. Indiva’s production facility, based in London, Ontario, includes aeroponic, environmentally-conscious grow rooms and a nearly completed extraction and manufacturing space, which will be able to process 70 tonnes of biomass annually and produce safe, high-quality cannabis-infused edibles. In Canada, Indiva will produce and distribute Ruby Cannabis Sugar, Sapphire Salt, Ruby Gems, as well as the award-winning Bhang Chocolate, and other derivative products through licence agreements and joint ventures. Click here to connect with INDIVA on social media and here to find more information on the Company and its products.

MEDIA CONTACT

Kate Abernathy

Vice President of Communications

Phone: 613-296-5764

Email: [email protected]

INVESTOR CONTACT

Steve Low

Investor Relations

Phone: 647-620-5101

Email: [email protected]

DISCLAIMER & READER ADVISORY

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has in any way passed upon the merits of the Transaction and neither of the foregoing entities accepts responsibility for the adequacy or accuracy of this release or has in any way approved or disapproved of the contents of this press release.

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the parties’ current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the Company’s future operations, future product offerings and entry into additional markets, changes to laws and regulations in Canada and internationally, and compliance with applicable regulations. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to the parties. The material factors and assumptions include the parties being able to obtain the necessary regulatory and other third parties’ approvals and licensing and other risks associated with regulated entities in the cannabis industry. The forward-looking information contained in this release is made as of the date hereof and the parties are not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. Not for distribution to U.S. Newswire Services or for dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. Securities laws.