Indiva Reports Record Fourth Quarter and Fiscal Year 2020 Results

Indiva Remains the National Leader in Edibles

LONDON, Ontario – May 13, 2021: Indiva Limited (the “Company” or “Indiva”) (TSXV:NDVA) (OTCQX:NDVAF), the leading Canadian producer of cannabis edibles and other cannabis products, is pleased to announce its financial and operating results for the fourth quarter and fiscal year ended December 31, 2020. All figures are reported in Canadian dollars ($), unless otherwise indicated. Indiva’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). For a more comprehensive overview of the corporate and financial highlights presented in this press release, please refer to Indiva’s Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Year Ended December 31, 2020, and the Company’s Consolidated Financial Statements for the Years Ended December 31, 2020 and 2019, which are filed on SEDAR and available on the Company’s website, www.indiva.com.

“We are pleased to report record revenue in the fourth quarter and for the fiscal year. 2020 was a transformational year for Indiva, seeing our net revenue increase 15-fold versus the prior year as a result of receiving our edibles sales licence in January 2020, and subsequently beginning sales nationally of Bhang® Chocolate and Wana™ Sour Gummies in February 2020 and September 2020, respectively. In that short time, Indiva has become the edibles category leader in Canada. Growth in the fourth quarter specifically was driven by new SKUs, including the introduction of four additional Wana Sour Gummies flavours across Canada,” said Niel Marotta, President and Chief Executive Officer of Indiva. “Since the end of the year, Indiva has introduced further new Wana gummie products, including three Wana Quick flavours, bringing our gummie SKU count to 10 unique SKUs in total. Data indicates that Indiva continues to hold leading market share in the edibles category, and Indiva’s edible category market share continued to improve through the end of March 2021. We are also very pleased to have closed a $22 million strategic investment by Sundial Growers Inc. subsequent to year-end. This cash influx significantly strengthens Indiva’s balance sheet and provides the capital required to scale our output, and maintain our sales momentum. Looking ahead to 2021, as the economy and stores reopen, we expect continued robust growth in the Canadian cannabis sector, with above average growth expected for the edibles category. Indiva looks forward to continuing to bring best-in-class products to of-age cannabis consumers in Canada.”

HIGHLIGHTS

Quarterly Performance

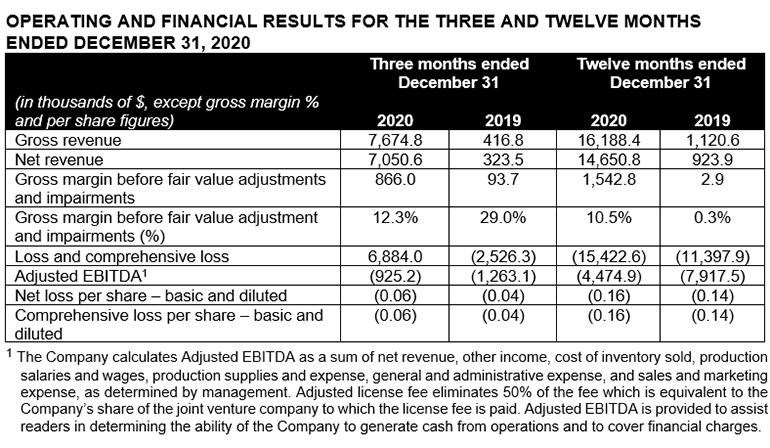

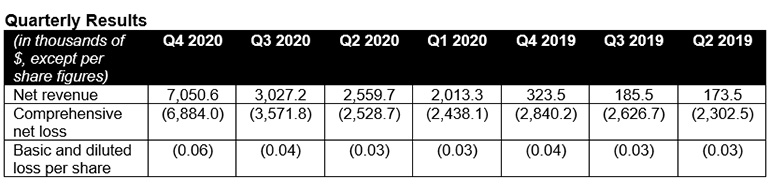

- Gross revenue in Q4 2020 was $7.67 million representing a 124% sequential increase from Q3 2020, and a 1,741% increase year-over-year from Q4 2019.

- Net revenue in Q4 2020 was $7.05 million representing a 133% sequential increase from Q3 2020, and a 2,080% increase year over year from Q4 2019, driven primarily by sales of category leading edibles such as Wana Sour Gummies and Bhang Chocolate.

- Net revenue from edible products grew to $5.92 million, up 178% from $2.13 million in Q3 2020 and nil in the prior year period. Edible product sales represent 84% of net revenue in Q4 2020.

- Gross profit before fair value adjustments and impairments improved to $0.87 million, but declined to 12.3% of net revenue versus 22.2% in Q3 2020 and 29.0% in Q4 2020. The decline in gross margin percentage was due to higher cost distillate used in production and a shift in product mix in the fourth quarter towards edible products with higher cannabinoid content, as the company introduced three new Wana SKUS with higher CBD content. The Company expects margins to improve significantly throughout 2021 as the company had worked through substantially all finished goods inventory containing higher cost distillate by the end of Q1 2021.

- Impairment charges in the quarter totaled $1.87 million. This write-off includes a provision for aged finished goods and bulk cannabis products due to aging inventory, high costs of cannabis inputs from early in 2020, and slower moving oil-based products. The Company will continue to work through such inventory as the majority of it remains saleable.

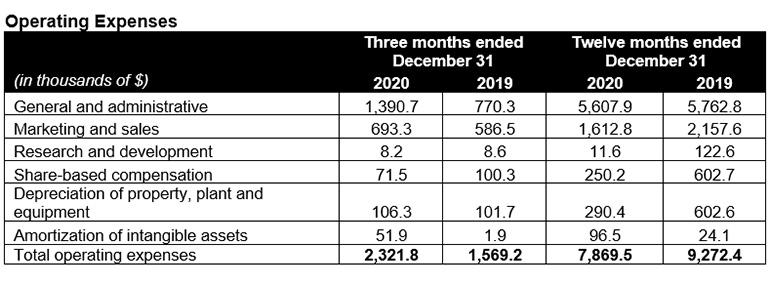

- Operating expenses in the quarter increased by 48% versus Q4 2019 due to higher marketing, sales and administrative costs and increased by 7% versus the three months ended September 30, 2020, primarily due to higher marketing and sales expenses offset by lower administrative costs.

- Comprehensive net loss included one-time expenses and non-cash charges including losses on non-refundable deposits and disposal of equipment totaling $4.44 million. Excluding these charges, comprehensive loss declined to $2.44 million versus a loss of $2.45 million in Q4 2019.

Fiscal Year 2020 Performance

- Gross revenue for the year ended 2020 was $16.2 million versus $1.1 million for the year ended December 2019, representing a 1,372% year-over-year increase.

- Net revenue for the year ended 2020 was $14.65 million versus $0.92 million for the year ended December 2019, representing a 1,492% year-over-year increase. Net revenue growth was driven primarily by sales of category leading edibles including Wana Sour Gummies and Bhang Chocolate.

- Net revenue from edible products grew to $11.2 million representing 76.4% of net revenue for the year ended December 2020, versus nil in the prior year period.

- Gross margin before fair value adjustments and impairments improved to $1.54 million or 10.5% of net revenue versus nil for the year-ended 2019, due to the introduction of edible products subsequent to the Company receiving its sale license in January 2020.

- Operating expenses decreased by 15% versus the year-ended 2019, primarily due to improved cost controls, lower marketing and sales expenses, lower share-based compensation and capitalization of costs related to production.

- Comprehensive net loss included one-time expenses and non-cash charges including losses on non-refundable deposits and disposal of equipment totaling $6.72 million. Excluding these charges, comprehensive loss declined to $8.70 million in fiscal year 2020 versus a loss of $10.45 million in fiscal year 2019.

Operational Highlights for the Fiscal Year 2020

- On January 31, 2020, Indiva received its edibles, extracts and topicals sales licence.

- Indiva closed the final tranche of an unsecured debenture financing for a cumulative $4.65 million in gross proceeds.

- Indiva began its first shipments of Bhang Chocolate to provincial wholesalers in February 2020.

- In March 2020, Indiva partnered with award-winning Wana Brands (“Wana”) to bring their innovative cannabis-infused products to Canada. Wana is the premiere U.S. edibles company with more dollars sold than any other brand according to BDS Analytics’ 2019 Brand Share Report.

- Indiva entered into an amended license agreement with Bhang, replacing the previous joint-venture agreement, giving the Company the exclusive right to manufacture and sell Bhang® THC-infused chocolate products in Canada.

- Indiva received a license amendment adding 10,000 square feet of processing space at its London, Ontario facility. With this amendment, Indiva’s production facility became fully licensed.

- In August 2020, the Company closed the final tranche of its equity unit private placement for total gross proceeds of $5.1 million.

- Indiva secured an agreement with CannMart Inc., a wholly owned subsidiary of Namaste Technologies Inc., which will see INDIVA™ CBD Softgels and INDIVA™ Indica Capsules available on CannMart’s B2C distribution channel for their medical customers, as well as Bhang® Chocolate and Wana™ Sour Gummies.

- Indiva made its first shipments of Artisan Batch premium craft cannabis to provincial wholesalers.

- Indiva began commercial production of Wana™ Sour Gummies in August 2020 and began shipments to provincial wholesalers in September 2020.

- Indiva signed an agreement with Medical Cannabis by Shoppers Inc., a subsidiary of Shoppers Drug Mart Inc. which will see Bhang® Chocolate and Wana™ Sour Gummies sold through the Medical Cannabis by Shoppers™ platform.

- Indiva expanded its distribution to eight provinces and one territory.

Events Subsequent to Year End

- The Company closed a $22 million debt and equity placement with Sundial on February 23, 2021. As a result of the investment, the company’s working capital position has improved substantially subsequent to year end.

- Indiva announced an extension to its License Agreement with Wana Brands Inc, under which Indiva will continue to have the exclusive right to produce and distribute Wana products, including gummies and soft chews, in Canada. The amended agreement shall be for a five year term, and may be extended for three additional five year terms.

- Indiva expanded its distribution to 9 provinces and 2 territories, adding a supply agreement with the province of Newfoundland in Q1 2021, and a distribution platform in the North West Territories.

- Indiva products became available for purchase through Medical Cannabis by Shoppers™, a subsidiary of Shoppers Drug Mart Inc. making Bhang® Chocolate and Wana™ Sour Gummies available through the Medical Cannabis by Shoppers™ platform. Indiva also entered into an agreement to supply AbbaMedix with Indiva cannabis products, bringing total medical distribution partners to three.

- Indiva introduced three additional gummie SKUs nationally under the Wana Quick brand in March 2021.

- Indiva introduced new high-potency, craft grown cultivars to the Canadian market under its Artisan Batch brand, including D. Bubba from Canandia, which became available for sale in Ontario and Quebec in April 2021.

- Indiva strengthened its board of directors with the addition of Mr. Russell Wilson to the Company’s board. Wilson is Vice President, Business Development with W. Brett Wilson’s holding company Prairie Merchant Corporation (“PMC“), where he manages PMC’s portfolio of cannabis and technology holdings, as well as participation in the company’s extensive and diversified holdings in real estate, power/energy, sports and agriculture.

Market Share

- Sell through data from Hifyre for the month of March 2021 shows strong sell-through of Indiva edible products. With a 46% share of sales, up from 45% in the month of February 2021, Indiva continues to expand its lead in the #1 market share position in the edibles category:

- Ontario #1 with 45% market share. Note: OCS data put Indiva market share in the Edibles category at 44.61% for March, down slightly from 44.86% in February.

- Alberta #1 with 49% market share.

- British Columbia #1 with 49% market share.

- Saskatchewan #2 with 23% market share.

- Manitoba #1 with 48% market share.

- Wana™ Sour Gummies led the edibles category with 33% category share.

- Bhang® led the chocolate category, with Bhang® Milk Chocolate remaining the top selling chocolate edible SKU nationally.

- Product Ranking in March 2021 showed the top 6 SKUs are Wana™ Sour Gummies (led by Strawberry-Lemonade) and 8 of the Top 10 SKUs are from Indiva.

- Based on Hifyre data from British Columbia, Alberta, Ontario and Saskatchewan, the edibles category improved in March 2021 to a record $10.7 million in retail sales versus $4.8 million in March 2020. Turning to OCS data, the edibles category in Ontario grew to a new record of $3.65 million in March 2021.

- Going forward, the Company will address quarterly market share in conjunction with the release of its quarterly financial results.

Outlook

- Indiva will introduce two new Bhang chocolate flavours nationally in Q2 2021, including Bhang Cookies & Cream and Bhang Mocha Caramel. The Company has received POs from provincial wholesalers for Cookies & Cream, and has delivered product in May 2021.

- Indiva intends to introduce new, innovative edible products, including Ruby Jewel chewable tablets, as well as Ruby Sugar in the second half of 2021.

- Indiva also expects to continue to introduce additional craft cannabis flower SKUs under the Artisan Batch brand, with special focus on high THC potency, robust terpene content, premium buds and fresh harvest dates.

COVID-19

Government and private entities are still assessing the present and future effects of the COVID-19 pandemic. Indiva has continued to operate with enhanced health and safety protocols in place to protect its employees. The Company continues to assess the customer, supply chain, and staffing implications of COVID-19 and is committed to making continuous adjustments to minimize disruption and impact. Indiva will remain proactive in its response to the pandemic and compliant with any and all provincial and/or federal policy enacted to protect Canadians.

CONFERENCE CALL

The Company will host a conference call to discuss its results on Thursday, May 13, 2021 at 4:30pm EST. Interested participants can join by dialing 416-764-8658 or 1-888-886-7786. The conference ID number is 96254765.

A recording of the conference call will be available for replay following the call. To access the recording please dial 416-764-8691 or 1-877-674-6060. The replay ID is 254765#. The recording will remain available until Friday May 28, 2021.

About Indiva

Indiva sets the standard for quality and innovation in cannabis. As a Canadian licensed producer, Indiva creates premium pre-rolls, flower, capsules, and edible products and provides production and manufacturing services to peer entities. In Canada, Indiva produces and distributes the award-winning Bhang® Chocolate, Wana™ Sour Gummies, Wana Quick, Ruby® Jewels Chewable Tablets Ruby® Cannabis Sugar, Sapphire™ Cannabis Salt, Artisan Batch, and other Powered by INDIVA™ products through license agreements and partnerships. Click here to connect with Indiva on LinkedIn, Instagram, Twitter and Facebook, and here to find more information on the Company and its products.

Contacts

Investor Contact

Anthony Simone

Phone: 416-881-5154

Email: [email protected]

Disclaimer and Reader Advisory

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has in any way passed upon the merits of the contents of this press release and neither of the foregoing entities accepts responsibility for the adequacy or accuracy of this release or has in any way approved or disapproved of the contents of this press release.

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the parties’ current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the Company’s future operations, future product offerings and compliance with applicable regulations. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to the parties. The material factors and assumptions include the parties being able to maintain the necessary regulatory and other third parties’ approvals and licensing and other risks associated with regulated entities in the cannabis industry. The forward-looking information contained in this release is made as of the date hereof and the parties are not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. Not for distribution to U.S. Newswire Services or for dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. Securities laws.